All Categories

Featured

Table of Contents

[/video]

When the major annuity holder dies, a selected beneficiary remains to obtain either 50% or 100% of the income permanently. 60 years 6,291.96 6.29% Requirement Life 65 years 6,960.24 6.96% Canada Life 70 years 7,776.60 7.78% Canada Life 75 years 8,941.56 8.94% Canada Life The existing ideal 50% joint life annuity price for a 65-year-old man is 6.96% from Canada Life, which is 0.24% lower than the ideal price in February.

describes the person's age when the annuity is established up. These tables reveal annuities where income repayments stay degree for the duration of the annuity. Escalating plans are also readily available, where repayments start at a reduced degree yet boost each year in line with the Retail Prices Index or at a set price.

For both joint life examples, figures revealed are based upon the first life being male, and the beneficiary being a lady of the exact same age. Solitary life, degree 7,545.60 7,554.12 7,458.72 7,496.40 7,435.08 7,444.92 Single life, intensifying at 3% 5,390.40 5,399.16 5,341.80 5,425.80 5,673.36 5,535.84 Single life, intensifying at RPI 4,795.92 4,804.80 4,722.96 4,778.28 5,067.96 4,946.16 Joint life 50% 6,952.92 6,960.96 6,834.12 6,896.76 7,143.84 7,064.64 Joint life 100% 6,385.68 6,392.64 6,262.92 6,318.60 6,683.76 6,691.80 Info on historic annuity prices from UK carriers, produced by Retired life Line's internal annuity quote system (usually at or near the first day of each month).

In enhancement: is where settlements start at a lower degree than a degree strategy, but boost at 3% every year. is where settlements begin at a reduced degree than a level plan, but enhance every year in line with the Retail Rate Index. Utilize our interactive slider to demonstrate how annuity rates and pension plan pot dimension impact the earnings you might get: Annuity prices are an important consider determining the level of revenue you will certainly obtain when purchasing an annuity with your pension cost savings.

The higher annuity rate you protect, the more revenue you will certainly receive. For example, if you were purchasing a life time annuity with a pension fund of 100,000 and were provided an annuity rate of 5%, the yearly earnings you receive would be 5,000. Annuity rates differ from supplier to company, and carriers will certainly provide you a personal price based upon a number of factors consisting of underlying financial factors, your age, and your health and lifestyle for lifetime annuities.

This offers you assurance and reassurance about your long-term retired life earnings. Nonetheless, you could have an escalating lifetime annuity. This is where you can pick to begin your settlements at a reduced degree, and they will then raise at a fixed percent or according to the Retail Cost Index.

Lincoln Financial Fixed Annuity Rates

With both of these options, when your annuity is established up, it can not typically be changed., the rate remains the exact same up until the end of the selected term.

It might amaze you to find out that annuity rates can vary significantly from provider-to-provider. In truth, at Retirement Line we have located a distinction of as high as 15% in between the most affordable and highest possible rates offered on the annuity market. Retirement Line specialises in supplying you a comparison of the most effective annuity rates from leading service providers.

(additionally known as gilts) to money their clients' annuities. This in turn funds the normal revenue settlements they make to their annuity customers. Service providers fund their annuities with these bonds/gilts because they are amongst the best kinds of investment.

When the Financial institution Rate is low, gilt returns are additionally reduced, and this is reflected in the pension plan annuity price. On the other hand, when the Bank Rate is high, gilt returns and typical annuity rates also have a tendency to rise.

Annuity suppliers utilize added financial and business variables to identify their annuity rates. This is why annuity prices can climb or drop despite what takes place to the Bank Price or gilt returns. The vital thing to keep in mind is that annuity rates can transform regularly. They also commonly differ from provider-to-provider.

Annuity Videos

This was of course good information to people who were ready to turn their pension pot into a surefire revenue. Canada Life's report at that time stated a benchmark annuity for a 65-year-old making use of 100,000 to purchase an annuity paying an annual lifetime income of 6,873 per year.

This is because carriers won't simply base your rate on your age and pension plan fund size. They will certainly rather base it on your private personal conditions and the kind of annuity you desire to take. This information is for illustratory purposes only. As we have actually defined over, your annuity service provider will base their annuity price on economic and commercial aspects, consisting of current UK gilt returns.

Ohio National Variable Annuity

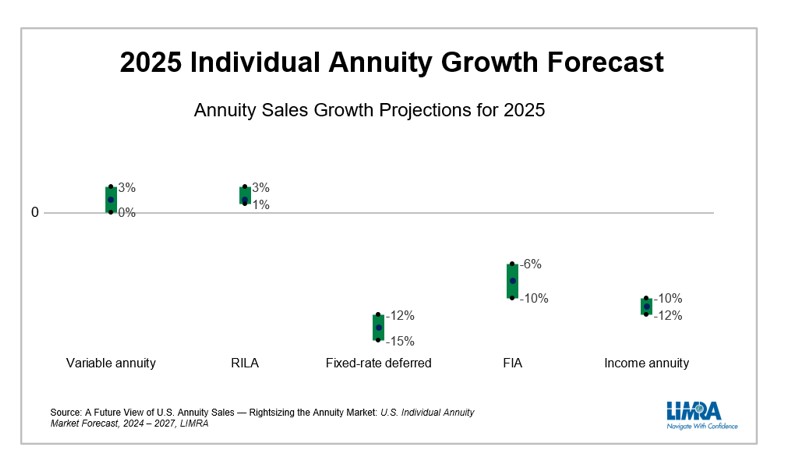

To put this into point of view, that's nearly dual the sales in 2021. In 2025, LIMRA is projecting FIA sales to drop 5%-10% from the record embeded in 2024 yet remain above $100 billion. RILA sales will certainly note its 11th consecutive year of record-high sales in 2024. Capitalists thinking about safeguarded development combined with proceeded solid equity markets has made this item popular.

LIMRA is projecting 2025 VA sales to be level with 2024 outcomes. After record-high sales in 2023, earnings annuities propelled by compelling demographics trends and appealing payout rates need to exceed $18 billion in 2024, setting another document. In 2025, reduced rates of interest will certainly force service providers to drop their payment prices, causing a 10% cut for income annuity sales.

Transamerica Annuity Distribution Form

It will certainly be a mixed overview in 2025 for the overall annuity market. While market problems and demographics are very positive for the annuity market, a decline in rate of interest (which thrust the exceptional growth in 2023 and 2024) will undercut set annuity products continued development. For 2024, we anticipate sales to be more than $430 billion, up between 10% to 15% over 2023.

The business is likewise a hit with agents and consumers alike. "They're A+ ranked.

The firm sits atop one of the most recent version of the J.D. Power Overall Consumer Fulfillment Index and flaunts a solid NAIC Complaint Index Score, too. Pros Market leader in customer contentment Stronger MYGA rates than some various other very rated companies Cons Online product information can be stronger Extra Insights and Professionals' Takes: "I have never had a disappointment with them, and I do have a number of satisfied clients with them," Pangakis said of F&G.

The company's Secure MYGA consists of benefits such as motorcyclists for terminal disease and assisted living facility arrest, the ability to pay the account value as a death benefit and prices that exceed 5%. Few annuity companies succeed greater than MassMutual for customers that value monetary stamina. The firm, established in 1851, holds a respected A++ score from AM Finest, making it one of the best and greatest companies available.

"I've listened to a great deal of advantages about them." MassMutual offers a number of solid items, including revenue, repaired and variable choices. Its Secure Voyage annuity, for instance, provides a traditional way to generate earnings in retired life coupled with manageable surrender costs and numerous payment alternatives. The firm likewise advertises authorized index-linked annuities via its MassMutual Ascend subsidiary.

Annuities Alternatives

"Nationwide stands out," Aamir Chalisa, general manager at Futurity First Insurance coverage Team, informed Annuity.org. "They've obtained fantastic consumer solution, a very high ranking and have actually been around for a number of years. Whether you want to produce earnings in retired life, grow your money without a lot of threat or take benefit of high rates, an annuity can effectively achieve your objectives.

Annuity.org established out to identify the top annuity business in the sector. These include a business's financial stamina, schedule and standing with clients.

Latest Posts

Motley Fool Annuities

How Much Can You Make Selling Annuities

Tiaa Fixed Annuity